"9710" and "9810" that cross-border e-commerce export B2B must understand

Creation time:2021-06-22 11:06:48The article details

Article 9710

1. What is 9710

The customs supervision code 9710 is referred to as "B2B direct export of cross-border e-commerce", which is applicable to goods directly exported by B2B of cross-border e-commerce.

B2B direct export mode of cross-border e-commerce refers to the mode in which domestic enterprises carry out online commodity and enterprise information display and establish contact with foreign enterprises through cross-border e-commerce platform, and complete the process of communication, order placing, payment and contract performance online or offline, so as to realize the export of goods.

2.9710 Declaration requirements

Enterprises that choose B2B direct export of cross-border e-commerce (9710) shall upload the online order screenshot generated by the trading platform and other trading electronic information before application, and fill in the key information in the online order, such as consignee name, goods name, number of pieces, gross weight and so on. Enterprises providing logistics services should upload electronic logistics information. The declaration agent shall fill in the business information of the entrusting enterprise corresponding to the goods. Orders that complete online payment within the trading platform can optionally upload their collection information.

3. Participating subjects and transaction process

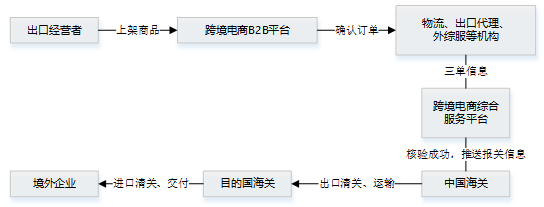

In the mode of B2B direct export of cross-border e-commerce (9710), it mainly involves: cross-border e-commerce export enterprises, cross-border e-commerce platform enterprises (domestic or overseas B2B platforms), logistics enterprises, foreign trade comprehensive service enterprises, overseas procurement enterprises and other participants.

Flow chart of B2B direct export of cross-border e-commerce:

4.9710 the advantage of

Lower the threshold for small and medium-sized enterprises to participate in international trade. In the traditional form of foreign trade, small, medium and micro enterprises or individuals are difficult to obtain the corresponding import and export qualifications due to their small scale and lack of funds. Therefore, it is difficult for them to participate in international trade alone. They can only use foreign trade agents to achieve import and export, which requires them to bear large capital costs and risks. What's more, small, medium and micro enterprises usually only produce intermediate products, unable to timely communicate with end customers and obtain effective market feedback, thus losing the possibility of establishing their own brand and high premium. At the present stage, B2B platforms of cross-border e-commerce make the fragmented, small and mobile trade process very simple and easier to operate. Micro, small and medium-sized enterprises and individuals can find buyers from all over the world through cross-border e-commerce B2B platform, which has greatly lowered the threshold to participate in global trade.

Benefit in obtaining new foreign trade users. Cross-border e-commerce B2B has changed the trade chain of "factory-foreign trade enterprise-foreign trade enterprise-foreign retail enterprise-consumers" in the past, enabling domestic export enterprises to directly communicate with overseas consumers and small businesses, the two new customer groups, so that China has become a customized supply chain service center to support global sellers.

It helps to capture new markets. At present, the association of south-east Asian nations (asean), the Middle East, Africa, Latin America and other cross-border electricity has become a fast-growing emerging market, small and medium-sized foreign trade enterprises through cross-border electric business platform can equal to participate in the emerging market competition, relying on small and medium-sized foreign trade enterprise agile supply chain, can quickly adapt to the personalized consumption in emerging markets, access to new market space.

Facilitate the spin-off of new services. In the new trade chain, the demand of foreign buyers has been derived from the single product purchase to brand planning, product design, marketing and promotion, logistics services and other comprehensive service needs, for domestic factories, trade enterprises to expand new profit promotion space.

Article 9810

1. What is 9810

The customs supervision code 9810 is referred to as "cross-border e-commerce export overseas warehouse", which is applicable to goods exported from overseas warehouse by cross-border e-commerce.

Cross-border e-commerce export overseas warehouse mode refers to a goods export mode in which domestic enterprises export goods in bulk to overseas warehouses through cross-border logistics in a general trade way. After online transactions are completed on cross-border e-commerce platforms, the goods are then delivered from overseas warehouses to overseas consumers. That is, cross-border e-commerce B2B2C export.

2.9810 Declaration requirements

Enterprises that choose cross-border e-commerce to export overseas warehouse (9810) need to upload electronic information of overseas warehouse booking form such as overseas warehouse commission service contract, and fill in key information such as overseas warehouse address and commissioned service term before application. After the warehousing of export goods, the electronic warehousing information should be uploaded, and the key information such as the name of the commodity and warehousing time should be filled in. The declaration agent shall fill in the business information of the entrusting enterprise corresponding to the goods.

The "three documents information" declared by the enterprise shall be the same batch of goods information (documents 1: declaration list, logistics list; Sheet 2: Trading orders, overseas warehouse booking orders; Documents 3: logistics bill). The application enterprise shall be responsible for the authenticity of the electronic information uploaded and the information filled in.

3. Participating subjects and transaction process

Cross-border e-commerce export overseas warehouse mode mainly involves: cross-border e-commerce export enterprises, logistics enterprises, comprehensive foreign trade service enterprises, public overseas warehouse operating enterprises, cross-border e-commerce platform enterprises (domestic or overseas B2C platforms), overseas logistics enterprises, overseas consumers and other participants.

Export flow chart of B2B2C overseas warehouse of cross-border e-commerce:

4.9810 the advantage of

The essence of cross-border e-commerce overseas warehouse export is the upgrading and evolution of cross-border e-commerce B2C retail export. By preparing goods in advance of overseas warehouse, goods can be delivered to overseas consumers more quickly. The purpose is to serve overseas cross-border e-commerce consumers more efficiently and improve the overall operating efficiency of cross-border e-commerce retail export. Especially in this year's epidemic, the important role of overseas warehouse for foreign trade enterprises is more prominent.

Delivery efficiency increased by more than 70%. Cross-border logistics has a relatively long chain, with the main links including domestic logistics, domestic customs, foreign customs and foreign logistics, etc. Even in the form of air logistics, it usually takes about 15 days to reach consumers, and it also faces risks such as high breakage rate and peak season congestion. Export mode, B2B2C overseas storehouse goods into the hands of the consumers only need to experience a foreign domestic logistics links, other parts have lead to complete, greatly shortens the time of logistics and even can achieve the same day, up to the next day, damage and reduce the packet loss rate at the same time, consumers purchase experience, promote the consumer after purchase.

Sales volume increased by more than 20%. After the goods enter the overseas warehouse, in the cross-border e-commerce platform, the location of the goods is the local place. When overseas consumers buy goods, in order to shorten the time of receiving goods, they usually choose the local delivery first. Therefore, the export of overseas warehouse helps to increase the sales volume. In this outbreak, according to the industry sources, in the United States, Britain, Germany and Australia due to the outbreak of overseas warehouse trading increased significantly, about 20 to 25 percent. In addition, since the logistics time in the overseas warehouse export mode is greatly shortened, the logistics disputes caused by the long logistics time and the untimely logistics information of consumers are significantly reduced, which is obviously beneficial to the increase of commodity trading volume and rapid payment collection.

Logistics costs are lower. Cross-border e-commerce B2C direct mail exports are mainly postal parcels, and its logistics usually adopts the air passenger to bring goods. In recent years, the price of E-Youbao has been rising year by year. However, B2B2C first exports commodities to overseas warehouses in bulk in the general way of trade, and the logistics method is usually mainly sea transportation, with a relatively lower cost. Take 3C digital products as an example, the freight of B2C direct mail is about 120 yuan, and the freight of B2B2C sea freight to overseas warehouse is about 60 yuan. Lower logistics costs mean higher profit margins for exporters.

After-sale service is more guaranteed. In B2C mode, when goods are returned or replaced, due to the high cost and long time of redelivery, most sellers will return the order. However, the goods are usually destroyed and discarded locally. Even if the goods are replaced, it is likely to lead to negative comments from overseas consumers and poor after-sales experience. Under B2B2C mode, goods can be effectively returned and replaced through overseas warehouses. Returned goods can also be repaired and repackaged through overseas warehouses, or shipped back to China in batches for maintenance, bringing consumers a higher quality after-sales service guarantee.

Customs clearance supervision of 9710 and 9810

Customs clearance system. For the cross-border B2B direct export goods (9710) and overseas warehouse export goods (9810) exported by cross-border e-commerce with the single bill amount of less than RMB 5,000 and not involved in license, inspection or tax, enterprises can choose the unified version of cross-border e-commerce or H2018 customs clearance management system for customs clearance. Goods declared through the unified version of cross-border e-commerce do not need to collect the declaration form. For goods not involved in export tax rebate, the declaration can be simplified in accordance with 6-digit HS code. For cross-border e-commerce B2B direct export (9710) and cross-border e-commerce export overseas warehouse (9810) with a single bill of more than 5,000 yuan or related to license, inspection and tax, enterprises must go through the H2018 Customs Clearance Management System for clearance.

Return of goods supervision. Goods exported through the supervision code 9710 and 9810 can be returned. For those returned to China within one year, the import duty is exempted, and the sales can be imported without tax rebate.

Other information

- Pioneer Express China-Europe Truck Flight: Building a Land-Based Golden Corridor Connecting Asia-Pacific to Eurasia

- Poland Border Closure: Pioneer Express Activates Southern China-Europe Trucking Emergency Plan to Safeguard China-Europe Trade Lifeline

- China-Europe Trucking (Flagship) – Global ATA Carnet Logistics Expert, 12 Years Leading International Temporary Import/Export Transportation

- Bridging Market Gaps! China-Europe Truck Aviation (Pathfinder) Caucasus Line: A New Eurasian Logistics Artery Empowering Businesses to Seize Opportunities

- Ceika: the superior choice for special equipment transportation in Europe and Asia

- Sino-Europe Trucking (Navigator) opened TIR truck transport line for new energy photovoltaic products in Europe and Central Asia